Inflation: What is it?

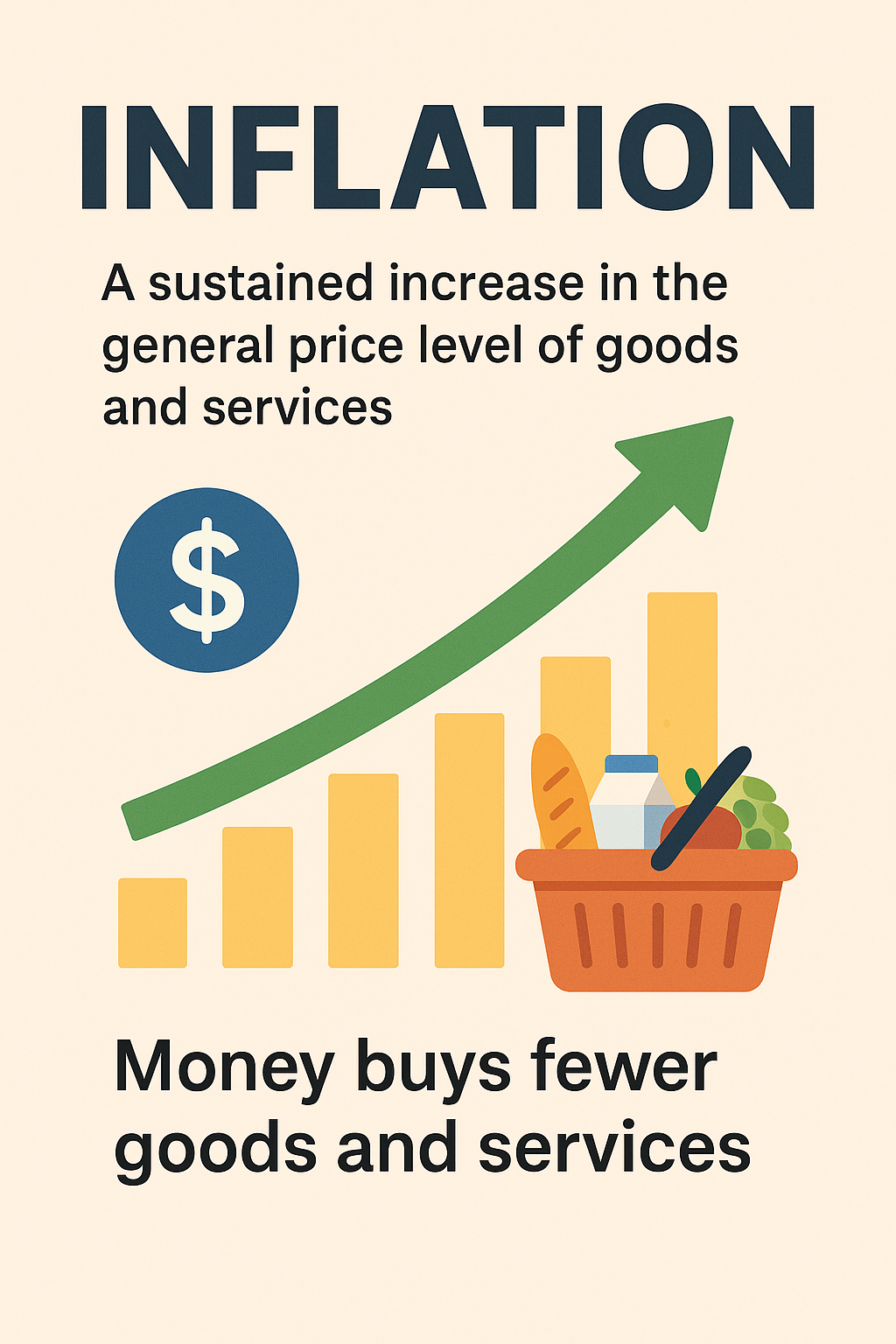

The general price level of goods and services in an economy rising steadily over time, resulting in a decline in the purchasing power of money, is referred to as inflation.

Put another way, each unit of currency can purchase fewer goods or services than it could in the past when inflation is present.

From the standpoint of a simple dictionary:

- “a gradual rise in prices that devalues money.”

How to Calculate Inflation

- In order to calculate inflation, economists usually examine a “basket” of goods and services that households purchase and monitor changes in the average price of that basket over time.

- The Consumer Price Index (CPI) is one often used metric.

- The percentage change in that price level over a given time period, usually a year, is known as the inflation rate.

The Primary Causes of Inflation

1. Inflation Driven by Demand

- Prices typically rise when the economy’s total demand for goods and services increases more quickly than its ability to supply them. To put it simply: “too much money chasing too few goods.”

2. Inflation Driven by Costs

- Inflation is pushed by producers raising prices to preserve margins if the cost of producing goods and services rises (for example, as a result of rising wages, raw material prices, or energy costs).

3. Inflation Expectations & Wage-Price Spiral: Inherent Inflation

- A self-reinforcing cycle occurs when workers demand higher wages because they anticipate inflation will continue, and businesses raise prices as a result of the higher wage costs.

Additional contributing factors to inflation

The monetary policy: Inflationary pressures may increase if the money supply expands quickly in comparison to output.

Shocks to the supply: Costs may increase as a result of supply disruptions (energy, raw materials, logistics, etc.).

Inflation from imports: Domestic prices may increase when a nation’s imports become more expensive or its currency depreciates.

The Effects of Inflation on the Economy and You

For homes

- Your money buys less: Your real purchasing power decreases if your income doesn’t increase in line with inflation.

- Cost of living increases: Lower-income households are particularly impacted by rising costs for necessities like food, utilities, and housing.

For investors and companies

- Costs and prices start to fluctuate, which may influence investment choices.

- Interest rates may increase: In response to inflationary pressures, central banks usually raise interest rates, which makes borrowing more expensive.

Regarding the economy

- Since it may promote investment and consumption rather than money hoarding, moderate inflation is frequently regarded as beneficial.

- Inflation that is high or rising is dangerous: In the worst situation, it can cause hyperinflation, erode savings, and skew economic judgements.

- The sweet spot is low and stable inflation; deflation, or falling price levels, has its own risks.

The Present Situation of Inflation

- In July 2025, the U.S. inflation rate (CPI) was approximately 2.70% year over year.

- A slight increase in core inflation—which does not include volatile food and energy—indicates underlying inflationary pressure.

- In response to a question about whether the 4% target is still the best, the Reserve Bank of India, India’s central bank, announced that it will maintain the current inflation-targeting framework.

Why inflation is important, both internationally and in India

- Global spillovers: Changes in currency, trade, and commodity prices can all be affected by inflation in large economies.

- The price of imports (such as components and oil) can contribute to domestic inflation in nations like India.

- Policy decisions about interest rates, subsidies, taxes, and fiscal spending are all influenced by the rate of inflation.

What Are the Options? How to Manage Inflation

The monetary policy: Interest rates are raised by central banks to slow inflation and decrease demand, or to slow the expansion of the money supply.

Budgetary policy: Governments can limit subsidies that worsen inflation, cut spending, or raise taxes (to lower demand).

Enhancements on the supply side: Cost-push inflation can be decreased by increasing productivity, strengthening supply chains, and removing bottlenecks.

Management of inflation expectations: Wage-price spirals can be avoided by central banks communicating to anchor expectations.